The listing of ferroalloy futures contracts means that a bridge will be established between the existing steel futures and iron ore futures, and a series of futures varieties in the steelmaking industry chain will be formed and improved. Realize the overall and interactive pricing and risk management of the steelmaking industry chain, thereby greatly improving the ability, level and efficiency of futures to serve the steelmaking industry chain. In order to further understand the background, original design and innovation of ferroalloy futures, the author interviewed the relevant person in charge of Zhengzhou Commodity Exchange. The following is the interview record.

Q: What is the significance of listing ferroalloy futures?

ZCE: This is a simple and complex issue that is easy to ignore but cannot be ignored, because the understanding of this issue is related to "where do ferroalloy futures come from and where are they going". Here, I would like to express my understanding of the listing of ferroalloy futures from four perspectives around "how is steel made".

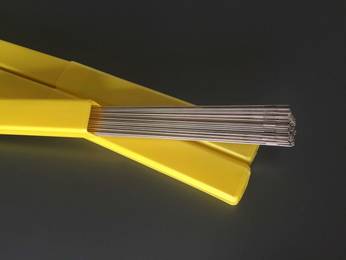

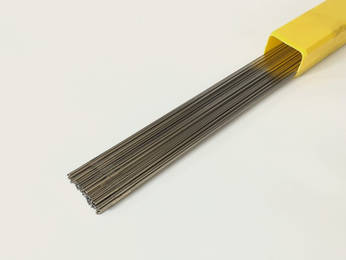

First, from the perspective of natural properties, the smelting of steel includes two steps: one is smelting iron ore into pig iron, and the other is smelting pig iron + ferroalloy into steel. Ferroalloy, iron ore and steel together form a closely related chain. Steelmaking industry chain. Among them, ferroalloys are deoxidizers, additives, reducing agents, and monosodium glutamate in steelmaking, so they are important industrial commodities. The most important varieties are ferrosilicon and silicon manganese. How to reflect this importance is one of the starting points for our research and launch of ferroalloy futures.

Second, from the perspective of market attributes, the smelting of steel includes two elements: one is quantity, and the other is price. In terms of volume, 1 ton of steel consumes about 4 kg of ferrosilicon and 14 kg of manganese silicon. In 2013, the output of ferrosilicon and silico-manganese was 5.97 million tons and 11.03 million tons respectively; in terms of price, ferroalloy and iron ore, steel The price correlation coefficient is high. How to avoid this risk of price fluctuations is the second starting point for our research and launch of ferroalloy futures.

Third, from the perspective of industrial relations, the smelting of steel requires the ferroalloy industry and the steel industry to form a business model of equal negotiation, negotiation, and win-win, the core of which lies in the judgment and decision of ferroalloy prices. At present, compared with iron and steel enterprises, ferroalloy enterprises have low enterprise concentration, small enterprise scale, unequal bargaining power with steel mills, and lack of market-oriented trading platform and environment, resulting in the imperfection of the existing ferroalloy price formation mechanism, which is difficult to fully Reflect the market supply and demand relationship. How to optimize the transaction structure of stakeholders between upstream and downstream of ferroalloy is the third starting point for our research and launch of ferroalloy futures.

Fourth, from the perspective of financial services, the refining of steel needs to be extended to the refining of futures in the steel industry chain. At present, the basic functions of futures to discover prices and avoid risks, as well as the extended functions of futures such as improving industrial concentration, resolving industrial surplus, promoting structural adjustment, and realizing transformation and upgrading, have been increasingly recognized, valued and utilized; on this basis, by introducing ferroalloys Futures, build a bridge between the existing steel futures and iron ore futures, form and improve a series of futures varieties in the steelmaking industry chain, and use the arbitrage mechanism between the three varieties to realize the overall integration of the steelmaking industry chain. , interactive pricing and risk management, thereby greatly improving the ability, level and efficiency of futures to serve the steelmaking industry chain. This is the fourth starting point for our research and launch of ferroalloy futures.

The smelting of steel requires the above-mentioned multi-level and multi-angle systematic consideration. During the research and design process of launching ferroalloy futures, we have a feeling: today's successful launch of ferroalloy futures is due to the great attention paid to ferroalloy futures by enterprises in the steelmaking industry chain, relevant investors, relevant ministries and industry associations, and many media. , appeal and support.

feihongalloys.com  View More

View More

View More

View More

View More

View More

View More

View More

View More

View More

View More

View More

.jpg?imageView2/2/w/346/format/jp2/q/70) View More

View More

View More

View More

View More

View More

View More

View More

View More

View More

View More

View More